W2 payroll calculator

Run payroll for hourly salaried and tipped employees. A 1099 vs W2 pay difference calculator can be a great tool for employers and hiring managers.

Payroll Calculator Free Employee Payroll Template For Excel

A form W2 is a wage and tax statement that allows you or your employer a way to report employee income and the taxes withheld over the year.

. Harvards Central Payroll processes wage payments to all employees at the University issuing over 30000 W-2 forms per year. But if you dont receive your tax returns you can download and print our w2 form online. Calculate net paycheck federal taxes payroll withholdings including SDI and SUI payroll state taxes with ease and on the.

Using eSmartPaycheck you can prepare paychecks calculate federal and state taxes print checks and pay stubs and print 941 and W2 forms for free. You may also contact the Central Payroll Bureau in Annapolis at 410-260-7964. Works well with an electronic payroll software Try it with our paystub generator today Business Checks.

Earning Statements with iPay. Use QuickBooks free payroll tax map to learn the payroll tax laws by state and important tax information when hiring your first employee. AGI helps you to determine your federalstate income taxes and also your eligibility for certain tax credits.

Payroll Journal Payroll Register Employees W2 and 109910981096 forms. W-2 employee is the default classification for any worker who you cant classify as a 1099 contractor. 202223 Tax Refund Calculator.

As many already know 1099 contractors must pay both the employee and employer portion of the payroll taxes. Banner Pay HolidayClosure Calendars W2 1095C Information Michigan Education Savings Program. Code W in Box 12 of your W2 indicates that you have an employer-sponsored Health Savings Account and that there was money deposited into your HSA through the payroll system at work.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. ESmart Payroll has been providing IRS authorized payroll e-file since 2000.

Many companies like these offer w2 lookup online. The list of Advanced Payroll Memos for Comptroller of Maryland. The forms are accessible for download and tax filing.

If you are having issues logging in filing or paying taxes use these troubleshooting tips. Fast easy accurate payroll and tax so you save time and money. 2020 W-4 IRS Withholding Calculator.

Salary Calculator Contact Us FAQs. Many Employers Have W2 Lookup Online. If you still need help acquiring a replacement W2 contact the Financial Services help line at 410-704-5599 option 1 or finservehelp AT_TOWSON.

ADP Wisely Pay Card. We consistently update our features to incorporate government relief programs and changes. To change your tax withholding amount.

Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. Skipped Health Deductions Schedule. Intuit QuickBooks Basic Payroll Standard Payroll Enhanced Payroll and Enhanced Payroll for Accountants.

Sales 877 202-0537 Mon-Fri 6 AM to 6 PM Pacific Time Support We provide multiple support options so you can get assistance when you need it. Try another browser edit your bookmarks or clear your internet history and cache. AGI Adjusted Gross Income is an individuals total gross income after the deduction of certain allowable expenses.

NannyPay is secure and cost-effective nanny tax payroll management software for calculating taxes for your nanny babysitter housekeeper personal assistant or any household employee. You can prepare form 941 W-2 1099-misc and others one at a time online or upload a data file to file by the thousands. It is also important to put these pay conversions in the larger context of your business structure and employment practices.

This kind of paper pairs perfectly fine with financial institutions as it is printed on a specific kind of paper that meets security specifications and conditions. In addition your company will usually let you know they have made an online-based W2 lookup open to you. Compare the year-end pay stub information to the W2 statement.

Most companies will send you a W2 form by January 31st the following year. You may also receive a Form 1099SA if you spent any of the money in your HSA. Generate W2 and 1099 forms without the hassle.

Paycheck Calculator exempt Paycheck Calculator non-exempt Contact. In addition to the above AGI also determines the contribution amounts to IRAs and other qualified savings plans. Go here to get support for Basic Standard and Enhanced Payroll.

Or keep the same amount. Use your estimate to change your tax withholding amount on Form W-4. NannyPay nanny tax software will save you thousands of dollars over popular nanny tax.

You can print PDF copies after submission or ask us to print and mail forms W-2 W-2c and 1099-misc. As part of the Total Rewards Operations Center team in Human Resources Payroll is available to process paychecks taxes and direct deposit forms and help with all other payroll processes. After You Use the Estimator.

More than just a tax calculator NannyPay will maintain all your nanny tax payroll records. Explanation of Your W2. You are required to withhold Social Security and Medicare taxes and file payroll taxes for W-2 employees.

Additionally its up to you to provide your employees with the tools and supplies they need to get their jobs done. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. See a breakdown of your payroll expenses by employee expense type and more.

The majority of businesses and also the military services now provide free w2 online retrieval. Calculate your total tax due using the tax calculator updated to. Use free or paid Paycheck Calculator app and precise Payroll Guru app to calculate employees payroll check in the residence state.

Apply Visit Give Apply Visit Give. Among the services Central Payroll provides are assistance with salary verifications for housing and mortgage application payroll garnishments support I-9 processing and assistance and W-2 reprints. Code W opens up Form 8889 Health Savings Accounts on your tax return.

Employees get online access to pay stubs and tax forms and can update their banking and contact details. If you have questions regarding information within the W2 Tax Form or the 1095c Tax form please visit the Payroll Tax Forms Direct Deposit page. Payroll Employee Services is dedicated to serving the diverse university community by providing precise and timely remuneration to all staff faculty.

ADP Wisely Pay Card.

Nvai7b73uqmw5m

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Direct Deposit Pay Stub Template Free Download Payroll Template Template Printable Microsoft Word Templates

Payroll Calculator Free Employee Payroll Template For Excel

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Hr Management Payroll What To Know About Payroll Invoice Template If You Are A Treasurer Of A Company You Have T Invoice Template Payroll Template Payroll

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

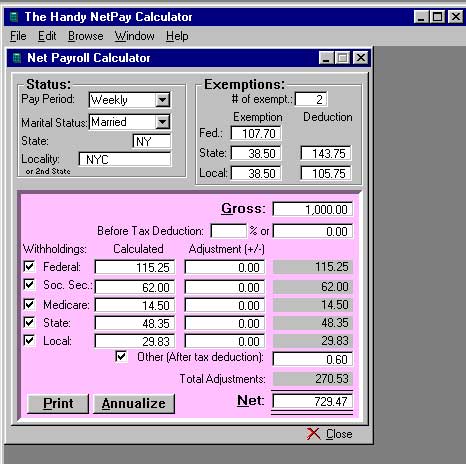

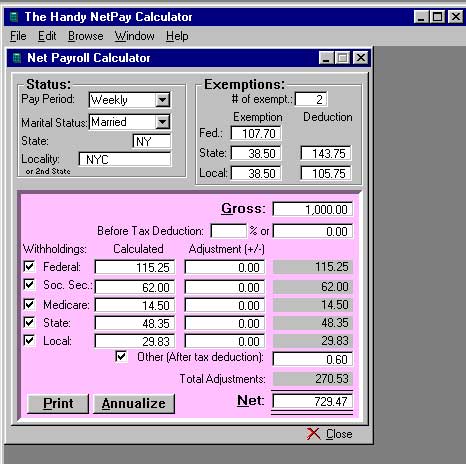

W 2 1099 Filer Software Net Pr Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms